Reinsurer Korean Re Switzerland uses e-signatures to digitally sign customer contracts

The potential for electronic signatures in the contract-heavy insurance industry is enormous. But most policies still take the long way around via printer, post and handwritten signature. It’s an enormous waste of time and resources. Until recently, high standards for security and compliance presented obstacles to the spread of e-signatures. The team at Korean Reinsurance Switzerland AG (Korean Re Switzerland) has shown that a different way is possible.

Sven Siegin is Head of Risk Management and Compliance and was instrumental in introducing e-signatures at Korean Re Switzerland. We’re excited to have the opportunity today to ask him about his experiences with e-signatures in the insurance industry.

Mr Siegin, could you say a few quick words about Korean Re Switzerland?

The Korean Re Group, based in Seoul (South Korea), is a global leader in reinsurance offering high-quality reinsurance services to its customers as a reliable business partner. Under its long-term goal of being one of the top three reinsurers in the world, the Korean Re Group has been active on the European market for almost 20 years. Korean Re Switzerland was founded in 2019 as a FINMA-regulated, independently capitalised subsidiary to drive greater business development on the European market.

What challenges prompted you to switch to e-signatures?

The main challenge for us was the same one facing the entire insurance industry: continued digitalisation of our processes. The double handwritten signature required for contracts and policies was time-consuming and cumbersome.

Let’s take a quick look back at the time before Korean Re Switzerland introduced e-signatures: what reservations did you have about digital signatures?

Switching to e-signing in an industry as regulated as ours takes a lot of effort. That’s also why many insurance companies are still struggling with it. In particular, we had some concerns about national and international legal validity. We also had questions about ease of use.

What arguments ultimately dispelled these doubts?

Skribble offers the qualified electronic signature (QES), which is legally equivalent to a handwritten signature. That took care of our concerns regarding legal certainty. At the same time, Skribble is so user-friendly and simple that we decided to take the step towards digitalisation.

How did you go about looking for the right provider? What criteria did you apply?

When we started to look into the issue, we weren’t familiar with the e-signatures market.

We analysed a variety of providers. One key criterion for us was coverage of all e-signature standards and, in particular, a fully integrated and user-friendly solution for the QES. Skribble also offers simple solutions for the identity check required for the QES by Swiss and EU law.

What do you need e-signatures for?

We use e-signatures to sign practically all reinsurance contracts with our customers, but also all documents in dealings with authorities and other contracting parties. Since most contracts arrive by e-mail, we can avoid taking the long way around through the printer and sign directly online. On top of that, the COVID-19 pandemic made physical signatures highly impractical.

Are there other processes where e-signatures are particularly helpful?

We use them first and foremost for customer contracts. We renew most of the policies for the coming year in the fourth quarter. It’s a very short period in which we have to sign an enormous number of contracts. We can now do that simply and efficiently using Skribble’s e-signature.

Can you expand on that a bit?

Since it was first introduced in the autumn of 2020, we’ve signed the majority of our contracts – more than 1,000 in total – using Skribble. Apart from the customer contracts, we also sign official reports on our website and documents for our parent company in Seoul.

Which departments at Korean Re Switzerland use Skribble?

Every employee in every position and every level of hierarchy already uses Skribble. Ballpoint pens are largely a thing of the past! It’s really fantastic that the QES has the same legal weight as a handwritten signature.

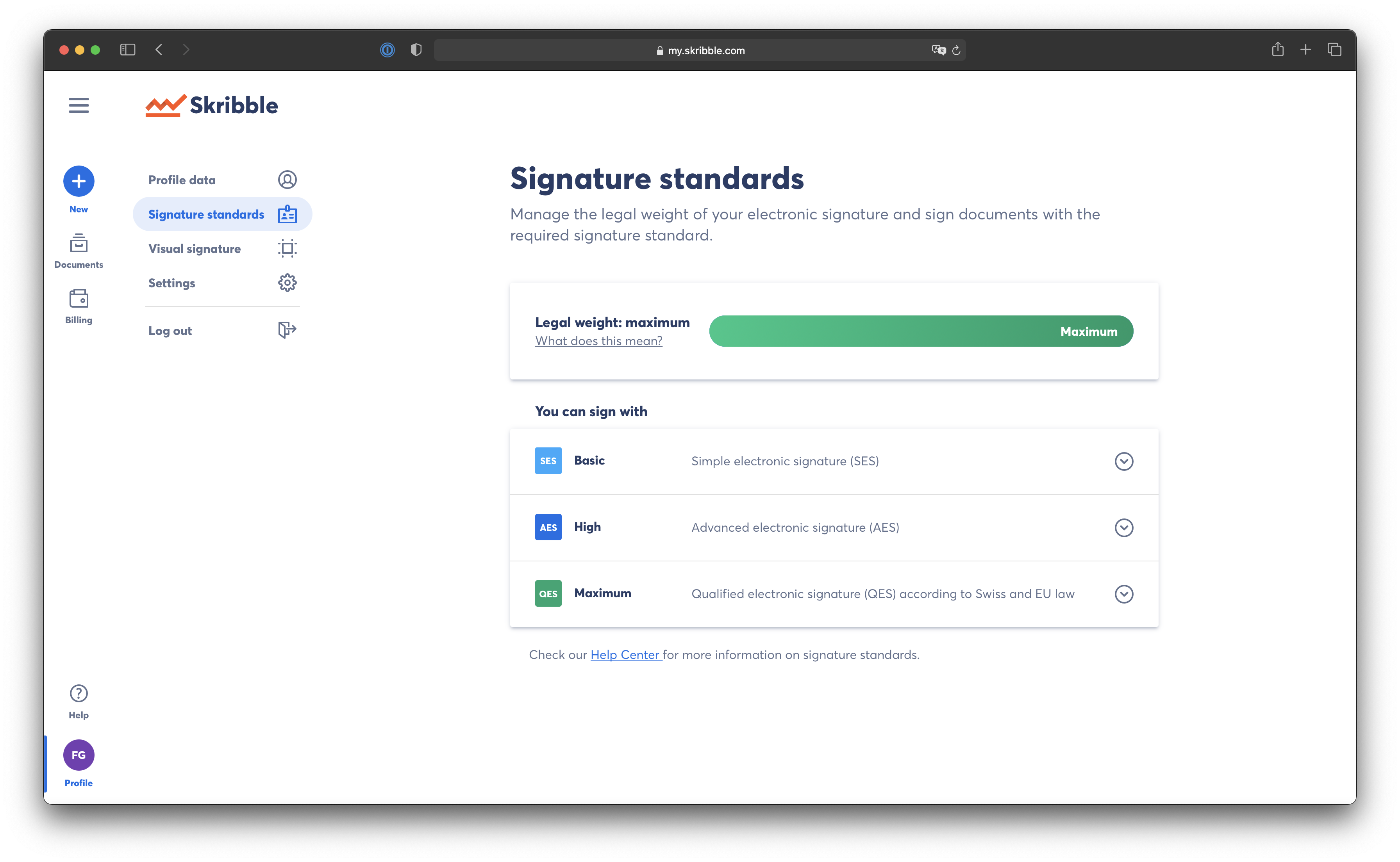

You said that you primarily sign using the QES. Do you also use the other legally defined e-signature standards, such as the simple (SES) and advanced electronic signature (AES)?

No. After internal deliberations, we defined the QES according to Swiss law as the standard for all employees and we sign documents with the highest level of security and maximum legal weight. That way we’re always on the safe side.

What has your experience of Skribble been like?

Our experience has been entirely positive. The whole process from the initial contact to introduction throughout the company ran completely smoothly. We didn’t even have to offer training since the tool is highly intuitive and it has only received positive feedback so far.

Do you use Skribble through a browser or have you integrated it into your own systems?

We use Skribble directly through the browser, so we didn’t have to integrate it into our systems. But we might consider a future API integration if growth continues. Thanks to the modern integration options Skribble offers, we should be able to do that without any problems, too.

Under the law, the QES requires a one-time identity check using an official proof of identity. Unlike in the EU, where you can do this from the comfort of home by video or through existing online banking, Swiss law requires a personal appearance on site. How did you handle that?

Identity checks of our employees were in fact the only administrative obstacle worth mentioning, but Skribble had an easy solution for that as well. A representative of Skribble came to our office, checked the ID cards of all our employees, and directly qualified them for the QES.

What added value can e-signatures offer specifically to (re-) insurance companies?

For many companies in the industry, it is precisely this final puzzle piece that is missing when it comes to digitalising their customer processes. The stumbling blocks so far have been the high standards for the legal certainty and legal weight of an electronic signature that is equivalent to a handwritten signature, along with ease of use. Thanks to Skribble’s intuitive QES solution and the methods of identification they provide, insurances can now easily switch to e-signatures.

In addition to efficiency gains, archiving in electronic form is also significantly easier, more secure, and above all saves more space.

Many thanks to Sven Siegin and Korean Re Switzerland for these fascinating insights into the world of e-signatures in a reinsurance company.