Mobiliar’s example shows that insurance companies are ready to switch to e-signatures

Mobiliar’s example shows why it’s time for insurance companies to switch to e-signatures. The leading Swiss insurer uses e-signatures for a growing number of applications – internally and externally. Mobiliar is so satisfied with the solution that it has even become an investor in Skribble, the Swiss TrustTech company.

The insurance industry is subject to high compliance and security requirements – including for the handwritten signatures that are needed in many processes. Many insurers have struggled to switch to e-signatures for this very reason. Mobiliar has shown that there’s another way.

Digital version of handwritten signature included

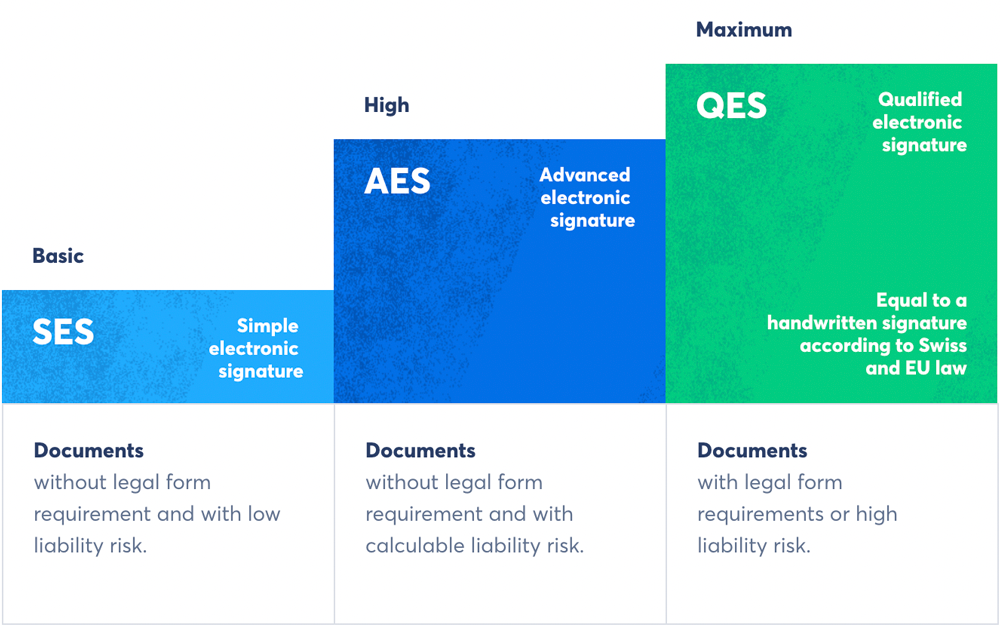

Of the three legally regulated e-signature standards, only the qualified electronic signature (QES) can replace a handwritten signature. It was clear to Mobiliar that a valid e-signing provider must satisfy this standard too.

Ulrich Moser, Head of Non-Life Software Engineering, MobiliarSkribble is extremely simple to use and offers a consistently positive customer experience.

With Skribble, all three e-signature standards are seamlessly integrated into the system and can be used as and when needed. That way, the right standard can be chosen for every process requiring a signature.

Unlike its competitors, Skribble requires no additional contracts with trust or identification service providers to sign with the highest standard QES – a unique offer in the e-signing industry.

All e-signature standards used

In addition to the QES, Mobiliar also uses the two other e-signature standards: the simple electronic signature (SES) and the advanced electronic signature (AES) – each as needed for the particular situation:

Sign with external parties without an account

A useful signature solution has to work for external parties without requiring them to create an account. Mobiliar uses e-signatures in IT procurement, where Skribble has been integrated into Fabasoft’s contract management tool.

Dominik Reber, IT Procurement, MobiliarSkribble’s digital signature has been integrated into our contract management process. It helps us, for example, to mutually sign contracts for external staff and services in a quick and audit-proof manner. We’re looking forward to further upgrades that will give us even more options for processes optimisation.

Employees sign contracts directly in Fabasoft’s cloud application. The external counterparty can then easily provide a counter-signature without any need to create a Skribble account. The PDF contract documents exchanged are then archived in an audit-proof manner.

Data hosted exclusively in Europe

For financial service providers like insurance companies and banks, it is absolutely crucial that no data is stored in computing centres outside Europe. As a European provider, Skribble hosts all data on computers in Switzerland in compliance with FINMA regulations, with the same security requirements as those enforced by the 34 Swiss banks.

More applications for e-signatures planned

Mobiliar is currently reviewing additional areas of application, such as fund and lease agreements in asset management, FINMA documents in finance, HR documents (employment contracts, training agreements, employer references) and applications in its subsidiary companies like Protekta.

E-signatures digitalise analogue processes in the insurance industry and increase traceability – and are clearly better than handwritten signatures in particular, offering total transparency.

Thomas Kühne, Head of IT, MobiliarInvesting in Skribble is the perfect way to complement our involvement with SwissID. The added value that both solutions have to offer is multiplied by integrating them at the same time. It’s a perfect symbiosis and a prime example of collaboration in the Swiss technology ecosystem.

Mobiliar is a firm believer in the added value that Skribble offers, including and especially when compared to other e-signing providers. That’s why it became an investor in the Swiss TrustTech company in May 2020.

High compliance and security requirements: a snap for Skribble

Concerns about security, compliance and data privacy have discouraged most insurance companies from switching to e-signatures. Legally compliant signature solutions have – to date – often been cumbersome to use. That’s why many processes are only partially digitalised at present.

But the COVID-19 pandemic and the rise of remote working have made the need for a solution in the insurance industry more urgent. Mobiliar, Switzerland’s leading insurance company, has shown how insurers can tap into the potential that e-signatures have to offer for themselves.

About Mobiliar

Mobiliar, founded in 1826 as a cooperative society, is the oldest private insurance company in Switzerland. One in three households and businesses in Switzerland is insured with Mobiliar. Over 80 major branch offices with their own claims services in roughly 160 locations guarantee proximity to about 2.2 million customers. Mobiliar employs roughly 5,900 staff and offers 338 trainee positions in its home markets of Switzerland and the Principality of Liechtenstein.